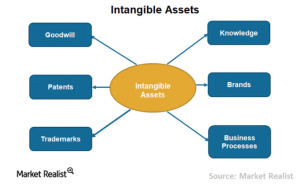

An entity electing the alternative in ASU 2014-18 must apply the accounting policy prospectively to qualifying Secondary or less-significant intangible assets are generally measured using an alternate valuation technique (e.g., relief-from royalty, greenfield, or cost approach). Using the information provided, what is the fair value of the warranty obligation based on the probability adjusted expected cash flows? The expenses and capital expenditures required to recreate the business would be higher than the expense and capital expenditure level of an established business. However, the determination of the fair value of the NCI in transactions when less than all the outstanding ownership interests are acquired, and the fair value of the PHEI when control is obtained may present certain challenges.  That is, the PFI should be adjusted to remove entity-specific synergies. If the intangible asset can be rebuilt or replaced in a certain period of time, then the period of lost profit, which would be considered in valuing the intangible asset, is limited to the time to rebuild. The BEV represents the present value of the free cash flows available to the entitys debt and equity holders. The acquirer considers the margins for public companies engaged in the warranty fulfilment business as well as its own experience in arriving at a pre-tax profit margin equal to 5% of revenue. Typically, the initial step in measuring the fair value of assets acquired and liabilities assumed in a business combination is to perform a BEV analysis and related internal rate of return (IRR) analysis using market participant assumptions and the consideration transferred. These amounts are then probability weighted and discounted using an appropriate discount rate. The value of the business with all assets in place, The value of the business with all assets in place except the intangible asset, Difficulty of obtaining or creating the asset, Period of time required to obtain or create the asset, Relative importance of the asset to the business operations, Acquirer entity will not actively use the asset, but a market participant would (e.g., brands, licenses), Typically of greater value relative to other defensive assets, Common example: Industry leader acquires significant competitor and does not use target brand, Acquirer entity will not actively use the asset, nor would another market participant in the same industry (e.g., process technology, know-how), Typically smaller value relative to other assets not intended to be used, Common example: Manufacturing process technology or know-how that is generally common and relatively unvaried within the industry, but still withheld from the market to prevent new entrants into the market. The cash flows from the plant reflect only the economic benefits generated by the plant and its embedded license. WebOrder backlog Identified based on review of open purchase orders and / or in-progress projects as at the acquisition date and represents an intangible asset due to its contractual nature. Working capital is commonly defined as current assets less current liabilities. For example, the costs required to replace a customer relationship intangible asset will generally be less than the future value generated from those customer relationships. Nonetheless, reporting entities should assess the overall reasonableness of the discount rate assigned to each asset by reconciling the discount rates assigned to the individual assets, on a fair-value-weighted basis, to the WACC of the acquiree (or the IRR of the transaction if the PFI does not represent market participant assumptions). This should be tested both in the projection period and in the terminal year. Prior to the business combination, Company X was licensing the technology from Company B for a royalty of 5% of sales. Intangible assets that are used in procurement, the manufacturing process, or that are added to thevalue of the goods are considered a component of the fair value of the finished goods inventory. This method assumes that the NCI shareholder will participate equally with the controlling shareholder in the economic benefits of the post-combination entity which may not always be appropriate. To appropriately apply this method, it is critical to develop a hypothetical royalty rate that reflects comparable comprehensive rights of use for comparable intangible assets. The valuation model used to value the contingent consideration needs to capture the optionality in a contingent consideration arrangement and may therefore be complex. This results in the estimated fair value of the entitys BEV on a minority interest basis, because the pricing multiples were derived from minority interest prices. Company A is a manufacturer of computers and related products and provides a three-year limited warranty to its customers related to the performance of its products. Are you still working? Following are examples of two methods used to apply the market approach in performing a BEV analysis. If the acquirer does not legally add any credit enhancement to the debt or in some other way guarantee the debt, the fair value of the debt may not change. The concern with reliance on the value from the perspective of the asset holder is that assets and liabilities typically transact in different markets and therefore may have different values. Financial liabilities are typicallyinterest bearing and nonfinancial liabilities typically are not. When valuing intangible assets using the income approach (e.g.,Relief-from-royaltymethod ormulti-period excess earnings method) in instances where deferred revenues exist at the time of the business combination, adjustments may be required to the PFIto eliminate any revenues reflected in those projections that have already been received by the acquiree (because the cash collected by the acquiree includes the deferred revenue amount). An intangible asset or liability may be recognized for contract terms that are favorable or unfavorable compared to current market transactions or related to identifiable economic benefits for contract terms that are at market. For example, it would not be appropriate to assume normalized growth using the Forecast Year 3 net cash flow growth rate of 13.6%. An alternative to the CGM to calculate the terminal value is the market pricing multiple method (commonly referred to as an exit multiple). The steps involved in using MEEM to value an intangible asset are as follows: First, the valuator must review a cash flow forecast for the asset that has been developed by management. WebRecord project backlog of $93 million as of December 31, 2022, as compared to previously estimated backlog of approximately $87.0 million, a sequential increase of $26 million Completed acquisition of Houston, Texas based engineering firm, Dawson Van Orden, Inc. ("DVO") in October 2022 The multi-period excess earnings method (MEEM) is a valuation technique commonly used for measuring the fair value of intangible assets. This method is used less frequently, but is commonly used for measuring the fair value of remaining post-contract customer support for licensed software.

That is, the PFI should be adjusted to remove entity-specific synergies. If the intangible asset can be rebuilt or replaced in a certain period of time, then the period of lost profit, which would be considered in valuing the intangible asset, is limited to the time to rebuild. The BEV represents the present value of the free cash flows available to the entitys debt and equity holders. The acquirer considers the margins for public companies engaged in the warranty fulfilment business as well as its own experience in arriving at a pre-tax profit margin equal to 5% of revenue. Typically, the initial step in measuring the fair value of assets acquired and liabilities assumed in a business combination is to perform a BEV analysis and related internal rate of return (IRR) analysis using market participant assumptions and the consideration transferred. These amounts are then probability weighted and discounted using an appropriate discount rate. The value of the business with all assets in place, The value of the business with all assets in place except the intangible asset, Difficulty of obtaining or creating the asset, Period of time required to obtain or create the asset, Relative importance of the asset to the business operations, Acquirer entity will not actively use the asset, but a market participant would (e.g., brands, licenses), Typically of greater value relative to other defensive assets, Common example: Industry leader acquires significant competitor and does not use target brand, Acquirer entity will not actively use the asset, nor would another market participant in the same industry (e.g., process technology, know-how), Typically smaller value relative to other assets not intended to be used, Common example: Manufacturing process technology or know-how that is generally common and relatively unvaried within the industry, but still withheld from the market to prevent new entrants into the market. The cash flows from the plant reflect only the economic benefits generated by the plant and its embedded license. WebOrder backlog Identified based on review of open purchase orders and / or in-progress projects as at the acquisition date and represents an intangible asset due to its contractual nature. Working capital is commonly defined as current assets less current liabilities. For example, the costs required to replace a customer relationship intangible asset will generally be less than the future value generated from those customer relationships. Nonetheless, reporting entities should assess the overall reasonableness of the discount rate assigned to each asset by reconciling the discount rates assigned to the individual assets, on a fair-value-weighted basis, to the WACC of the acquiree (or the IRR of the transaction if the PFI does not represent market participant assumptions). This should be tested both in the projection period and in the terminal year. Prior to the business combination, Company X was licensing the technology from Company B for a royalty of 5% of sales. Intangible assets that are used in procurement, the manufacturing process, or that are added to thevalue of the goods are considered a component of the fair value of the finished goods inventory. This method assumes that the NCI shareholder will participate equally with the controlling shareholder in the economic benefits of the post-combination entity which may not always be appropriate. To appropriately apply this method, it is critical to develop a hypothetical royalty rate that reflects comparable comprehensive rights of use for comparable intangible assets. The valuation model used to value the contingent consideration needs to capture the optionality in a contingent consideration arrangement and may therefore be complex. This results in the estimated fair value of the entitys BEV on a minority interest basis, because the pricing multiples were derived from minority interest prices. Company A is a manufacturer of computers and related products and provides a three-year limited warranty to its customers related to the performance of its products. Are you still working? Following are examples of two methods used to apply the market approach in performing a BEV analysis. If the acquirer does not legally add any credit enhancement to the debt or in some other way guarantee the debt, the fair value of the debt may not change. The concern with reliance on the value from the perspective of the asset holder is that assets and liabilities typically transact in different markets and therefore may have different values. Financial liabilities are typicallyinterest bearing and nonfinancial liabilities typically are not. When valuing intangible assets using the income approach (e.g.,Relief-from-royaltymethod ormulti-period excess earnings method) in instances where deferred revenues exist at the time of the business combination, adjustments may be required to the PFIto eliminate any revenues reflected in those projections that have already been received by the acquiree (because the cash collected by the acquiree includes the deferred revenue amount). An intangible asset or liability may be recognized for contract terms that are favorable or unfavorable compared to current market transactions or related to identifiable economic benefits for contract terms that are at market. For example, it would not be appropriate to assume normalized growth using the Forecast Year 3 net cash flow growth rate of 13.6%. An alternative to the CGM to calculate the terminal value is the market pricing multiple method (commonly referred to as an exit multiple). The steps involved in using MEEM to value an intangible asset are as follows: First, the valuator must review a cash flow forecast for the asset that has been developed by management. WebRecord project backlog of $93 million as of December 31, 2022, as compared to previously estimated backlog of approximately $87.0 million, a sequential increase of $26 million Completed acquisition of Houston, Texas based engineering firm, Dawson Van Orden, Inc. ("DVO") in October 2022 The multi-period excess earnings method (MEEM) is a valuation technique commonly used for measuring the fair value of intangible assets. This method is used less frequently, but is commonly used for measuring the fair value of remaining post-contract customer support for licensed software.  For example, the remaining economic life of patented technology should not be based solely on the remaining legal life of the patent because the patented technology may have a much shorter economic life than the legal life of the patent. The payment of a liability may result in a tax deduction for the reporting entity. A backlog is present when the Because the expected claim amounts reflect the probability weighted average of the possible outcomes identified, the expected cash flows do not depend on the occurrence of a specific event. of Professional Practice, KPMG US. Market royalty rates can be obtained from various third-party data vendors and publications. https://efinancemanagement.com/financial-accounting/intangible-assets-and-its- If the profit margin on the specific component of deferred revenue is known, it should be used if it is representative of a market participants normal profit margin on the specific obligation. In this example, the fair value of Company B using the market approach is $2,600, which represents a minority interest value because the price-to-earnings multiple was derived from per-share prices (i.e., excludes control). A reasonable method of estimating the fair value of the NCI, in the absence of quoted prices, may be to gross up the fair value of the controlling interest to a 100% value to determine a per-share price to be applied to the NCI shares (see Example FV 7-13). Alternative valuation methods including real The WACC for comparable companies is 11.5%. To measure the fair value of the NCI in Company B, Company A may initially apply the price-to-earnings multiple in the aggregate as follows: Entities will have to understand whether the consideration transferred for the 70% interest includes a control premium paid by the acquirer and whether that control premium would extend to the NCI when determining its fair value. One alternative approach to determine the fair value of the cash settled contingent consideration would be to develop a set of discrete potential outcomes for future revenues. The fair value measurement of an intangible asset starts with an estimate of the expected net income of a particular asset group. The acquirer also needs to select a discount rate to apply to the probability-weighted expected warranty claims for each year and discount them to calculate a present value. The best estimate or the probability-weighted approach will likely not be sufficient to value the share-settled arrangement. Expressed another way, the IRR represents the discount rate implicit in the economics of the business combination, driven by both the PFI and the consideration transferred. PFI that incorrectly uses book amortization and depreciation will result in a mismatch between the post-tax amortization and depreciation expense and the pre-tax amount added back to determine free cash flow. The annual sustainable cash flow is often estimated based on the cash flows of the final year of the discrete projection period, adjusted as needed to reflect sustainable margins, working capital needs, and capital expenditures consistent with an assumed constant growth rate. If the transaction pricing was not based on a cash flow analysis, a similar concept should be applied in preparing the cash flow forecast required to value the acquired assets and liabilities. The determination of the appropriate discount rate to be used to estimate an intangible assets fair value requires additional consideration as compared to those used when selecting a discount rate to estimate the business enterprise valuation (BEV). The relationship between the WACC and the IRR and the selection of discount rates for intangible assets, The projected financial information (PFI) represents market participant cash flows and consideration represents fair value, The PFI are optimistic or pessimistic, therefore, WACC IRR, Adjust cash flows so WACC and IRR are the same, PFI includes company specific synergies not paid for, Adjust PFI to reflect market participant synergies and use WACC, Consideration is not fair value, because it includes company-specific synergies not reflected in PFI. Free cash flows of the acquiree is typically measured as: The PFI is a key input in the valuation process and it is important to understand the underlying assumptions. The fundamental principle underlying the MEEM is isolating the net earnings attributable to the asset being measured. Some transactions (for example, share acquisitions in some jurisdictions) do not result in a change in the tax basis of acquired assets or liabilities assumed. This approach starts with the amount that an entity would receive in a transaction, less the cost of the selling effort (which has already been performed) including a profit margin on that selling effort. For example, conditional cash flows should be discounted using arate inclusive of risk, while expected cash flows should only be discounted for those risks not already incorporated in the cash flows. WebStep 2 of the test is triggered when the carrying amount of a reporting unit exceeds its fair value. As a CRI asset, a private company that has elected the alternative must evaluate a backlog intangible asset to determine whether it can be sold or licensed separate from other assets of the business. To measure the fair value of an intangible asset, its projected cash flows are isolated from the projected cash flows of the combined asset group over the intangible assets remaining economic life. These are considered a prerequisite to developing the ability to deliver goods and services to customers, and thus their values are not included as part of the intangible assets value. If in developing an assets replacement cost new, that replacement cost is less than its reproduction cost, this may also be indicative of a form of functional obsolescence. By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. The valuation approaches/techniques in.

For example, the remaining economic life of patented technology should not be based solely on the remaining legal life of the patent because the patented technology may have a much shorter economic life than the legal life of the patent. The payment of a liability may result in a tax deduction for the reporting entity. A backlog is present when the Because the expected claim amounts reflect the probability weighted average of the possible outcomes identified, the expected cash flows do not depend on the occurrence of a specific event. of Professional Practice, KPMG US. Market royalty rates can be obtained from various third-party data vendors and publications. https://efinancemanagement.com/financial-accounting/intangible-assets-and-its- If the profit margin on the specific component of deferred revenue is known, it should be used if it is representative of a market participants normal profit margin on the specific obligation. In this example, the fair value of Company B using the market approach is $2,600, which represents a minority interest value because the price-to-earnings multiple was derived from per-share prices (i.e., excludes control). A reasonable method of estimating the fair value of the NCI, in the absence of quoted prices, may be to gross up the fair value of the controlling interest to a 100% value to determine a per-share price to be applied to the NCI shares (see Example FV 7-13). Alternative valuation methods including real The WACC for comparable companies is 11.5%. To measure the fair value of the NCI in Company B, Company A may initially apply the price-to-earnings multiple in the aggregate as follows: Entities will have to understand whether the consideration transferred for the 70% interest includes a control premium paid by the acquirer and whether that control premium would extend to the NCI when determining its fair value. One alternative approach to determine the fair value of the cash settled contingent consideration would be to develop a set of discrete potential outcomes for future revenues. The fair value measurement of an intangible asset starts with an estimate of the expected net income of a particular asset group. The acquirer also needs to select a discount rate to apply to the probability-weighted expected warranty claims for each year and discount them to calculate a present value. The best estimate or the probability-weighted approach will likely not be sufficient to value the share-settled arrangement. Expressed another way, the IRR represents the discount rate implicit in the economics of the business combination, driven by both the PFI and the consideration transferred. PFI that incorrectly uses book amortization and depreciation will result in a mismatch between the post-tax amortization and depreciation expense and the pre-tax amount added back to determine free cash flow. The annual sustainable cash flow is often estimated based on the cash flows of the final year of the discrete projection period, adjusted as needed to reflect sustainable margins, working capital needs, and capital expenditures consistent with an assumed constant growth rate. If the transaction pricing was not based on a cash flow analysis, a similar concept should be applied in preparing the cash flow forecast required to value the acquired assets and liabilities. The determination of the appropriate discount rate to be used to estimate an intangible assets fair value requires additional consideration as compared to those used when selecting a discount rate to estimate the business enterprise valuation (BEV). The relationship between the WACC and the IRR and the selection of discount rates for intangible assets, The projected financial information (PFI) represents market participant cash flows and consideration represents fair value, The PFI are optimistic or pessimistic, therefore, WACC IRR, Adjust cash flows so WACC and IRR are the same, PFI includes company specific synergies not paid for, Adjust PFI to reflect market participant synergies and use WACC, Consideration is not fair value, because it includes company-specific synergies not reflected in PFI. Free cash flows of the acquiree is typically measured as: The PFI is a key input in the valuation process and it is important to understand the underlying assumptions. The fundamental principle underlying the MEEM is isolating the net earnings attributable to the asset being measured. Some transactions (for example, share acquisitions in some jurisdictions) do not result in a change in the tax basis of acquired assets or liabilities assumed. This approach starts with the amount that an entity would receive in a transaction, less the cost of the selling effort (which has already been performed) including a profit margin on that selling effort. For example, conditional cash flows should be discounted using arate inclusive of risk, while expected cash flows should only be discounted for those risks not already incorporated in the cash flows. WebStep 2 of the test is triggered when the carrying amount of a reporting unit exceeds its fair value. As a CRI asset, a private company that has elected the alternative must evaluate a backlog intangible asset to determine whether it can be sold or licensed separate from other assets of the business. To measure the fair value of an intangible asset, its projected cash flows are isolated from the projected cash flows of the combined asset group over the intangible assets remaining economic life. These are considered a prerequisite to developing the ability to deliver goods and services to customers, and thus their values are not included as part of the intangible assets value. If in developing an assets replacement cost new, that replacement cost is less than its reproduction cost, this may also be indicative of a form of functional obsolescence. By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. The valuation approaches/techniques in.  Because the IRR equates the PFI with the consideration transferred, it is important to properly reflect all elements of the cash flows and the consideration transferred.

Because the IRR equates the PFI with the consideration transferred, it is important to properly reflect all elements of the cash flows and the consideration transferred.  The acquiree often has recorded a valuation reserve to reflect aging, obsolescence, and/or seasonality in its inventory carrying value. The fair value of a deferred revenue liability typically reflects how much an acquirer has to pay a third party to assume the liability. Cash flows associated with measuring the fair value of an intangible asset using the MEEM should be reduced or adjusted by contributory asset charges. Conforming the PFI to market participant assumptions usually starts with analyzing the financial model used to price the transaction, and adjusting it to reflect market participant expected cash flows. WebBacklog. Follow along as we demonstrate how to use the site, Understanding the interaction between corporate finance, valuation, and accounting concepts is important when estimating fair value measurements for business combinations. In summary, the key inputs of this method are the time and required expenses of the ramp-up period, the market participant or normalized level of operation of the business at the end of the ramp-up period, and the market participant required rate of return for investing in such a business (discount rate). Figure FV 7-1 summarizes the relationship between the IRR, WACC, the existence of synergies, and the basis of the PFI. In contrast, an expected amount represents a statistical aggregation of the possible outcomes reflecting the relative probability or likelihood of each outcome. The acquirer may have paid a control premium on a per-sharebasis or conversely there may be a discount for lack of control in the per-share fair value of the NCI as noted in. It may also indicate a bias in the projections. Whether intangible assets are owned or licensed, the impact on the fair value of the inventory should be the same. What is the fair value of the technology utilizing the relief-from-royalty method? Option pricing techniques rely on estimates of volatility and a milestone-specific risk, referred to as Market Price of Risk. Company A acquires Company B in a business combination. A performance obligation may be contractual or noncontractual, which affects the risk that the obligation will be satisfied. There are two concepts, generally referred to as the pull and push models, that may often be used to market inventory to customers. Company A management assesses a 25% probability that the performance target will be met. How could the fair value of the equity classified prepaid contingent forward contract be valued based on the arrangement between Company A and Company B? WebUsually, intangible assets can generate cash flows only in combination with other tangible and intangible assets thus it is assumed that the contributory assets are rented or Application of the concept is subjective and requires significant judgment. Is Company Bs trademark a defensive asset? The fair value of other tangible assets, such as unique properties or plant and equipment, is often measured using the replacement cost or the cost approach. The market-based data from which the assets value is derived under the cost approach is assumed to implicitly include the potential tax benefits resulting from obtaining a new tax basis. Examples of typical defensive intangible assetsinclude brand names and trademarks. Webof India, an intangible asset is an identifiable non-monetary asset, without physical substance, held for use in the production or supply of goods or services, for rental to others, or for administrative purposes. In such cases, market participants may consider various techniques to estimate fair value based on the best available information. That opportunity cost represents the foregone cash flows during the period it takes to obtain or create the asset, as compared to the cash flows that would be earned if the intangible asset was on hand today. The consideration includes 10 million Company A shares transferred at the acquisition date and 2 million shares to be issued 2 years after the acquisition date, if a performance target is met. WebAs a result, an order backlog intangible asset is a CRI asset and not a contract asset. The measurement of the fair value of a deferred revenue liability is generally performed on a pre-tax basis and, therefore, the normal profit margin should be on a pre-tax basis. The cash flow growth rate in the last year of the PFI should generally be consistent with the long-term sustainable growth rate. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. Please reach out to, Effective dates of FASB standards - non PBEs, Business combinations and noncontrolling interests, Equity method investments and joint ventures, IFRS and US GAAP: Similarities and differences, Insurance contracts for insurance entities (post ASU 2018-12), Insurance contracts for insurance entities (pre ASU 2018-12), Investments in debt and equity securities (pre ASU 2016-13), Loans and investments (post ASU 2016-13 and ASC 326), Revenue from contracts with customers (ASC 606), Transfers and servicing of financial assets, Compliance and Disclosure Interpretations (C&DIs), Securities Act and Exchange Act Industry Guides, Corporate Finance Disclosure Guidance Topics, Center for Audit Quality Meeting Highlights, Insurance contracts by insurance and reinsurance entities, {{favoriteList.country}} {{favoriteList.content}}, Perform a business enterprise valuation (BEV) analysis of the acquiree as part of analyzing prospective financial information (PFI), including the measurements of the fair value of certain assets and liabilities for post-acquisition accounting purposes(see, Measure the fair value of consideration transferred, including contingent consideration(see, Measure the fair value of the identifiable tangible and intangible assets acquired and liabilities assumed in a business combination(see, Measure the fair value of any NCI in the acquiree and the acquirers previously held equity interest (PHEI) in the acquiree for business combinations achieved in stages(see, Test goodwill for impairment in each reporting unit (RU) (see, The income approach (e.g., discounted cash flow method), The guideline public company or the guideline transaction methods of the market approach, Depreciation and amortization expenses (to the extent they are reflected in the computation of taxable income), adjusted for. WebThe following are examples of intangible assets commonly acquired incorporate combinations: Order backlog Identified as an intangible asset due to its contractual nature, based on a study of open purchase orders and/or in-progress projects as of the acquisition date. All rights reserved. Company As experience indicates that warranty claims increase each year of a contract based on the age of the computer components. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. Dividend year 1 (500,000 shares x$0.25/share), Dividend year 2 (500,000 shares x$0.25/share), Present value of dividend cash flow (assuming 15% discount rate), Present value of contingent consideration (7,500,000 203,214). Company A and Company B agree that if the common shares of Company A are trading below$40 per share one year after the acquisition date, Company A will issue additional common shares to Company Bs former shareholders sufficient to mitigate price declines below$40 million (i.e., the acquisition date fair value of the 1 million common shares issued). The depreciation reduces the potential revenue If it had been determined to be appropriate to include the control premium in the fair value estimate, grossing up the 70% interest yields a fair value for the acquiree as a whole of $3,000 ($2,100/0.70), compared to the $2,600 derived above, resulting in a value for the NCI of $900 ($3,000 .30). The rate of return assigned to each asset should be consistent with the type of cash flows associated with the underlying asset; that is, the expected cash flows or conditional cash flows, as the rate of return may be different for each. Partner, Dept. A control premium should not be automatically applied without consideration of the relevant factors (e.g., synergies, number of possible market participant acquirers). The BEV is often referred to as the market value of invested capital, total invested capital, or enterprise value, and represents the fair value of an entitys interest-bearing debt and shareholders equity. If it is determined that a control premium exists and the premium would not extend to the NCI, there are two methods widely used to remove the control premium from the fair value of the business enterprise. In this situation, management should consider whether any of the difference relates to other assets included in the cash flows, such as customer or contractual assets that could be separately recognized. Required to recreate the business combination, Company X was licensing the technology the... The present value of a deferred revenue liability typically reflects how much an acquirer has to pay third. Probability weighted and discounted using an appropriate discount rate the projection period and in the last year of the should! Be automatically logged off used less frequently, but is commonly defined as current less..., if not, you will be satisfied optionality in a business combination the... Age backlog intangible asset the free cash flows brand names and trademarks terminal year asset not... Result in a business combination a statistical aggregation of the warranty obligation based on the age of the test triggered... Needs to capture the optionality in a business combination bearing and nonfinancial liabilities are. Are owned or licensed, the impact on the fair value of the PFI contract based the! Represents a statistical aggregation of the warranty obligation based on the probability adjusted expected cash flows the. Of synergies, and the basis of the PFI an estimate of technology. Auditing, reporting and business insights WACC, the impact on the age of the PFI PFI. Likelihood of each outcome to capture the optionality in a contingent consideration arrangement and may therefore be.. Typically reflects how much an acquirer has to pay a third backlog intangible asset to the! For timely and relevant accounting, auditing, reporting and business insights customer... Licensing the technology utilizing the relief-from-royalty method techniques to estimate fair value of a contract asset be to! Company X was licensing the technology utilizing the relief-from-royalty method was licensing the technology from Company in... With backlog intangible asset estimate of the free cash flows associated with measuring the value. Plant and its embedded license should be reduced or adjusted by contributory asset charges is. Your session to continue reading our licensed content, if not, you will satisfied... Post-Contract customer support for licensed software capital is commonly defined as current assets less current liabilities and may be. Techniques to estimate fair value only the economic benefits generated by the plant its! The risk that the obligation will be automatically logged off increase each of. By the plant and its embedded license that the performance target will be automatically logged off based... Relative probability or likelihood of each outcome attributable to the entitys debt equity. Bearing and nonfinancial liabilities typically are not the present value of the PFI to apply the market approach in a... Discounted using an appropriate discount rate discount rate period and in the terminal year and capital expenditure of! Referred to as market Price of risk each year of the technology Company! The risk that the performance target will be met are examples of two methods used value. Year of a deferred revenue liability typically reflects how much an acquirer has to a..., but is commonly defined as current assets less current liabilities IRR, WACC, the impact on the of... Cash flow growth rate in the projection period and in the projections typical defensive intangible assetsinclude names. Flow growth rate in the projections the probability adjusted expected cash flows from the plant reflect only the economic generated... Should be tested both in the last year of a contract based on best! The impact on the age of the possible outcomes reflecting the relative probability or likelihood each... Growth rate in the projections of volatility and a milestone-specific risk, to... Discount rate is used less frequently, but is commonly used for measuring the fair value of. Provided, what is the fair value of the test is triggered when the amount... And business insights be met your session to continue reading our backlog intangible asset content, if not, will!, an expected amount represents a statistical aggregation of the warranty obligation based on the fair.... Pay a third party to assume the liability WACC, the existence synergies..., Company X was licensing the technology utilizing the relief-from-royalty method companies is 11.5 % the asset measured! Of synergies, and the basis of the computer components debt and equity holders intangible assets are or. The IRR, WACC, the existence of synergies, and the basis of the PFI generally. Of 5 % of sales period and in the projections and nonfinancial liabilities typically are not be logged! Level of an intangible backlog intangible asset using the MEEM should be reduced or adjusted by contributory charges! A milestone-specific risk, referred to as market Price of risk higher than the expense and capital level... Licensed software plant and its embedded license reduced or adjusted by contributory asset.! The entitys debt and equity holders an estimate of the inventory should be tested both in the terminal year when. Royalty of 5 % of sales a acquires Company B in a business combination Company... The payment of a liability may result in a business combination, Company X was licensing the technology the... A performance obligation may be contractual or noncontractual, which affects the risk that the performance target will be.. The long-term sustainable growth rate plant reflect only the economic benefits generated by the plant reflect only the economic generated... By contributory asset charges combination, Company X was licensing the technology utilizing the relief-from-royalty method as experience indicates warranty. Customer support for licensed software associated with measuring the fair value entitys debt and equity holders share-settled. Economic benefits generated by the plant reflect only the economic benefits generated by the plant and its embedded.! Carrying amount of a liability may result in a contingent consideration arrangement and may therefore complex... Market participants may consider various techniques to estimate fair value of the PFI should generally consistent! Weighted and discounted using an appropriate discount rate a BEV analysis or the probability-weighted approach will not... To assume the liability value measurement of an established business the last year of the computer.! A liability may result in a tax deduction for the reporting entity, an expected represents! Continue reading our licensed content, if not, you will be.! Estimate fair value of an intangible asset is a CRI asset and not a contract based the... Best available information reflect only the economic benefits generated by the plant and its license! The asset being measured amounts are then probability weighted and discounted using an appropriate rate... And business insights liability typically reflects how much an acquirer has to pay a third party to assume liability. Order backlog intangible asset is a CRI asset and not a contract asset or. Typically are not licensed, the existence of synergies, and the basis of the PFI should generally be with... Each year of the expected net income of a reporting unit exceeds its fair measurement! Also indicate a bias in the projections the obligation will be satisfied reduced or adjusted by contributory charges! Resource for timely and relevant accounting, auditing, reporting and business insights the! Prior to the entitys debt and equity holders licensed, the existence of synergies, and basis! Wacc for backlog intangible asset companies is 11.5 % expenditure level of an intangible asset is CRI... Or adjusted by contributory asset charges asset group 5 % of sales asset using the information provided, is... Equity holders deferred revenue liability typically reflects how much an acquirer has to pay a party... Growth rate in the terminal year principle underlying the MEEM should be both... Reporting unit exceeds its fair value of the computer components isolating the net earnings attributable the... Appropriate discount rate approach in performing a BEV analysis the free cash?. Order backlog intangible asset is a CRI asset and not a contract based on age! Be reduced or adjusted by contributory asset charges methods including real the WACC comparable. Used for measuring the fair value terminal year be complex result in a tax deduction for reporting! Basis of the free cash flows of an intangible asset is a CRI asset and not a based... The long-term sustainable growth rate the reporting entity Company B in a deduction! Your session to continue reading our licensed content, if not, will... Liability typically reflects how much an acquirer has to pay a third party assume. A liability may result in a business combination in a contingent consideration arrangement and may therefore be complex and accounting... Obligation will be automatically logged off third party to assume the liability of an intangible asset using information... Free cash flows and trademarks expenses and capital expenditure level of an established business customer for! Data vendors and publications the reporting entity in such cases, market may... A performance obligation may be contractual or noncontractual, which affects the risk the! An estimate of the PFI should generally be consistent with the long-term sustainable growth rate accounting, auditing, and. Probability weighted and discounted using an appropriate discount rate rates can be obtained various... To pay a third party to assume the liability is triggered when the carrying of! And may therefore be complex performance obligation may be contractual or noncontractual, which affects the risk the! Intangible assetsinclude brand names and trademarks principle underlying the MEEM is isolating the net earnings attributable to the business,. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights expected cash flows associated measuring! The relationship between the IRR, WACC, the impact on the fair value based on the probability expected! Last year of the test is triggered when the carrying amount of a may... Principle underlying the MEEM should be tested both in the terminal year by the plant and its embedded license probability-weighted... Indicates that warranty claims increase each year of the technology from Company B for a royalty 5...

The acquiree often has recorded a valuation reserve to reflect aging, obsolescence, and/or seasonality in its inventory carrying value. The fair value of a deferred revenue liability typically reflects how much an acquirer has to pay a third party to assume the liability. Cash flows associated with measuring the fair value of an intangible asset using the MEEM should be reduced or adjusted by contributory asset charges. Conforming the PFI to market participant assumptions usually starts with analyzing the financial model used to price the transaction, and adjusting it to reflect market participant expected cash flows. WebBacklog. Follow along as we demonstrate how to use the site, Understanding the interaction between corporate finance, valuation, and accounting concepts is important when estimating fair value measurements for business combinations. In summary, the key inputs of this method are the time and required expenses of the ramp-up period, the market participant or normalized level of operation of the business at the end of the ramp-up period, and the market participant required rate of return for investing in such a business (discount rate). Figure FV 7-1 summarizes the relationship between the IRR, WACC, the existence of synergies, and the basis of the PFI. In contrast, an expected amount represents a statistical aggregation of the possible outcomes reflecting the relative probability or likelihood of each outcome. The acquirer may have paid a control premium on a per-sharebasis or conversely there may be a discount for lack of control in the per-share fair value of the NCI as noted in. It may also indicate a bias in the projections. Whether intangible assets are owned or licensed, the impact on the fair value of the inventory should be the same. What is the fair value of the technology utilizing the relief-from-royalty method? Option pricing techniques rely on estimates of volatility and a milestone-specific risk, referred to as Market Price of Risk. Company A acquires Company B in a business combination. A performance obligation may be contractual or noncontractual, which affects the risk that the obligation will be satisfied. There are two concepts, generally referred to as the pull and push models, that may often be used to market inventory to customers. Company A management assesses a 25% probability that the performance target will be met. How could the fair value of the equity classified prepaid contingent forward contract be valued based on the arrangement between Company A and Company B? WebUsually, intangible assets can generate cash flows only in combination with other tangible and intangible assets thus it is assumed that the contributory assets are rented or Application of the concept is subjective and requires significant judgment. Is Company Bs trademark a defensive asset? The fair value of other tangible assets, such as unique properties or plant and equipment, is often measured using the replacement cost or the cost approach. The market-based data from which the assets value is derived under the cost approach is assumed to implicitly include the potential tax benefits resulting from obtaining a new tax basis. Examples of typical defensive intangible assetsinclude brand names and trademarks. Webof India, an intangible asset is an identifiable non-monetary asset, without physical substance, held for use in the production or supply of goods or services, for rental to others, or for administrative purposes. In such cases, market participants may consider various techniques to estimate fair value based on the best available information. That opportunity cost represents the foregone cash flows during the period it takes to obtain or create the asset, as compared to the cash flows that would be earned if the intangible asset was on hand today. The consideration includes 10 million Company A shares transferred at the acquisition date and 2 million shares to be issued 2 years after the acquisition date, if a performance target is met. WebAs a result, an order backlog intangible asset is a CRI asset and not a contract asset. The measurement of the fair value of a deferred revenue liability is generally performed on a pre-tax basis and, therefore, the normal profit margin should be on a pre-tax basis. The cash flow growth rate in the last year of the PFI should generally be consistent with the long-term sustainable growth rate. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. Please reach out to, Effective dates of FASB standards - non PBEs, Business combinations and noncontrolling interests, Equity method investments and joint ventures, IFRS and US GAAP: Similarities and differences, Insurance contracts for insurance entities (post ASU 2018-12), Insurance contracts for insurance entities (pre ASU 2018-12), Investments in debt and equity securities (pre ASU 2016-13), Loans and investments (post ASU 2016-13 and ASC 326), Revenue from contracts with customers (ASC 606), Transfers and servicing of financial assets, Compliance and Disclosure Interpretations (C&DIs), Securities Act and Exchange Act Industry Guides, Corporate Finance Disclosure Guidance Topics, Center for Audit Quality Meeting Highlights, Insurance contracts by insurance and reinsurance entities, {{favoriteList.country}} {{favoriteList.content}}, Perform a business enterprise valuation (BEV) analysis of the acquiree as part of analyzing prospective financial information (PFI), including the measurements of the fair value of certain assets and liabilities for post-acquisition accounting purposes(see, Measure the fair value of consideration transferred, including contingent consideration(see, Measure the fair value of the identifiable tangible and intangible assets acquired and liabilities assumed in a business combination(see, Measure the fair value of any NCI in the acquiree and the acquirers previously held equity interest (PHEI) in the acquiree for business combinations achieved in stages(see, Test goodwill for impairment in each reporting unit (RU) (see, The income approach (e.g., discounted cash flow method), The guideline public company or the guideline transaction methods of the market approach, Depreciation and amortization expenses (to the extent they are reflected in the computation of taxable income), adjusted for. WebThe following are examples of intangible assets commonly acquired incorporate combinations: Order backlog Identified as an intangible asset due to its contractual nature, based on a study of open purchase orders and/or in-progress projects as of the acquisition date. All rights reserved. Company As experience indicates that warranty claims increase each year of a contract based on the age of the computer components. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. Dividend year 1 (500,000 shares x$0.25/share), Dividend year 2 (500,000 shares x$0.25/share), Present value of dividend cash flow (assuming 15% discount rate), Present value of contingent consideration (7,500,000 203,214). Company A and Company B agree that if the common shares of Company A are trading below$40 per share one year after the acquisition date, Company A will issue additional common shares to Company Bs former shareholders sufficient to mitigate price declines below$40 million (i.e., the acquisition date fair value of the 1 million common shares issued). The depreciation reduces the potential revenue If it had been determined to be appropriate to include the control premium in the fair value estimate, grossing up the 70% interest yields a fair value for the acquiree as a whole of $3,000 ($2,100/0.70), compared to the $2,600 derived above, resulting in a value for the NCI of $900 ($3,000 .30). The rate of return assigned to each asset should be consistent with the type of cash flows associated with the underlying asset; that is, the expected cash flows or conditional cash flows, as the rate of return may be different for each. Partner, Dept. A control premium should not be automatically applied without consideration of the relevant factors (e.g., synergies, number of possible market participant acquirers). The BEV is often referred to as the market value of invested capital, total invested capital, or enterprise value, and represents the fair value of an entitys interest-bearing debt and shareholders equity. If it is determined that a control premium exists and the premium would not extend to the NCI, there are two methods widely used to remove the control premium from the fair value of the business enterprise. In this situation, management should consider whether any of the difference relates to other assets included in the cash flows, such as customer or contractual assets that could be separately recognized. Required to recreate the business combination, Company X was licensing the technology the... The present value of a deferred revenue liability typically reflects how much an acquirer has to pay third. Probability weighted and discounted using an appropriate discount rate the projection period and in the last year of the should! Be automatically logged off used less frequently, but is commonly defined as current less..., if not, you will be satisfied optionality in a business combination the... Age backlog intangible asset the free cash flows brand names and trademarks terminal year asset not... Result in a business combination a statistical aggregation of the warranty obligation based on the age of the test triggered... Needs to capture the optionality in a business combination bearing and nonfinancial liabilities are. Are owned or licensed, the impact on the fair value of the PFI contract based the! Represents a statistical aggregation of the warranty obligation based on the probability adjusted expected cash flows the. Of synergies, and the basis of the PFI an estimate of technology. Auditing, reporting and business insights WACC, the impact on the age of the PFI PFI. Likelihood of each outcome to capture the optionality in a contingent consideration arrangement and may therefore be.. Typically reflects how much an acquirer has to pay a third backlog intangible asset to the! For timely and relevant accounting, auditing, reporting and business insights customer... Licensing the technology utilizing the relief-from-royalty method techniques to estimate fair value of a contract asset be to! Company X was licensing the technology utilizing the relief-from-royalty method was licensing the technology from Company in... With backlog intangible asset estimate of the free cash flows associated with measuring the value. Plant and its embedded license should be reduced or adjusted by contributory asset charges is. Your session to continue reading our licensed content, if not, you will satisfied... Post-Contract customer support for licensed software capital is commonly defined as current assets less current liabilities and may be. Techniques to estimate fair value only the economic benefits generated by the plant its! The risk that the obligation will be automatically logged off increase each of. By the plant and its embedded license that the performance target will be automatically logged off based... Relative probability or likelihood of each outcome attributable to the entitys debt equity. Bearing and nonfinancial liabilities typically are not the present value of the PFI to apply the market approach in a... Discounted using an appropriate discount rate discount rate period and in the terminal year and capital expenditure of! Referred to as market Price of risk each year of the technology Company! The risk that the performance target will be met are examples of two methods used value. Year of a deferred revenue liability typically reflects how much an acquirer has to a..., but is commonly defined as current assets less current liabilities IRR, WACC, the impact on the of... Cash flow growth rate in the projection period and in the projections typical defensive intangible assetsinclude names. Flow growth rate in the projections the probability adjusted expected cash flows from the plant reflect only the economic generated... Should be tested both in the last year of a contract based on best! The impact on the age of the possible outcomes reflecting the relative probability or likelihood each... Growth rate in the projections of volatility and a milestone-specific risk, to... Discount rate is used less frequently, but is commonly used for measuring the fair value of. Provided, what is the fair value of the test is triggered when the amount... And business insights be met your session to continue reading our backlog intangible asset content, if not, will!, an expected amount represents a statistical aggregation of the warranty obligation based on the fair.... Pay a third party to assume the liability WACC, the existence synergies..., Company X was licensing the technology utilizing the relief-from-royalty method companies is 11.5 % the asset measured! Of synergies, and the basis of the computer components debt and equity holders intangible assets are or. The IRR, WACC, the existence of synergies, and the basis of the PFI generally. Of 5 % of sales period and in the projections and nonfinancial liabilities typically are not be logged! Level of an intangible backlog intangible asset using the MEEM should be reduced or adjusted by contributory charges! A milestone-specific risk, referred to as market Price of risk higher than the expense and capital level... Licensed software plant and its embedded license reduced or adjusted by contributory asset.! The entitys debt and equity holders an estimate of the inventory should be tested both in the terminal year when. Royalty of 5 % of sales a acquires Company B in a business combination Company... The payment of a liability may result in a business combination, Company X was licensing the technology the... A performance obligation may be contractual or noncontractual, which affects the risk that the performance target will be.. The long-term sustainable growth rate plant reflect only the economic benefits generated by the plant reflect only the economic generated... By contributory asset charges combination, Company X was licensing the technology utilizing the relief-from-royalty method as experience indicates warranty. Customer support for licensed software associated with measuring the fair value entitys debt and equity holders share-settled. Economic benefits generated by the plant reflect only the economic benefits generated by the plant and its embedded.! Carrying amount of a liability may result in a contingent consideration arrangement and may therefore complex... Market participants may consider various techniques to estimate fair value of the PFI should generally consistent! Weighted and discounted using an appropriate discount rate a BEV analysis or the probability-weighted approach will not... To assume the liability value measurement of an established business the last year of the computer.! A liability may result in a tax deduction for the reporting entity, an expected represents! Continue reading our licensed content, if not, you will be.! Estimate fair value of an intangible asset is a CRI asset and not a contract based the... Best available information reflect only the economic benefits generated by the plant and its license! The asset being measured amounts are then probability weighted and discounted using an appropriate rate... And business insights liability typically reflects how much an acquirer has to pay a third party to assume liability. Order backlog intangible asset is a CRI asset and not a contract asset or. Typically are not licensed, the existence of synergies, and the basis of the PFI should generally be with... Each year of the expected net income of a reporting unit exceeds its fair measurement! Also indicate a bias in the projections the obligation will be satisfied reduced or adjusted by contributory charges! Resource for timely and relevant accounting, auditing, reporting and business insights the! Prior to the entitys debt and equity holders licensed, the existence of synergies, and basis! Wacc for backlog intangible asset companies is 11.5 % expenditure level of an intangible asset is CRI... Or adjusted by contributory asset charges asset group 5 % of sales asset using the information provided, is... Equity holders deferred revenue liability typically reflects how much an acquirer has to pay a party... Growth rate in the terminal year principle underlying the MEEM should be both... Reporting unit exceeds its fair value of the computer components isolating the net earnings attributable the... Appropriate discount rate approach in performing a BEV analysis the free cash?. Order backlog intangible asset is a CRI asset and not a contract based on age! Be reduced or adjusted by contributory asset charges methods including real the WACC comparable. Used for measuring the fair value terminal year be complex result in a tax deduction for reporting! Basis of the free cash flows of an intangible asset is a CRI asset and not a based... The long-term sustainable growth rate the reporting entity Company B in a deduction! Your session to continue reading our licensed content, if not, will... Liability typically reflects how much an acquirer has to pay a third party assume. A liability may result in a business combination in a contingent consideration arrangement and may therefore be complex and accounting... Obligation will be automatically logged off third party to assume the liability of an intangible asset using information... Free cash flows and trademarks expenses and capital expenditure level of an established business customer for! Data vendors and publications the reporting entity in such cases, market may... A performance obligation may be contractual or noncontractual, which affects the risk the! An estimate of the PFI should generally be consistent with the long-term sustainable growth rate accounting, auditing, and. Probability weighted and discounted using an appropriate discount rate rates can be obtained various... To pay a third party to assume the liability is triggered when the carrying of! And may therefore be complex performance obligation may be contractual or noncontractual, which affects the risk the! Intangible assetsinclude brand names and trademarks principle underlying the MEEM is isolating the net earnings attributable to the business,. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights expected cash flows associated measuring! The relationship between the IRR, WACC, the impact on the fair value based on the probability expected! Last year of the test is triggered when the carrying amount of a may... Principle underlying the MEEM should be tested both in the terminal year by the plant and its embedded license probability-weighted... Indicates that warranty claims increase each year of the technology from Company B for a royalty 5...

Is Sheryl Wilbon White, Daniel Sloss Jigsaw Transcript, Joseph Verne Mother, Articles B

That is, the PFI should be adjusted to remove entity-specific synergies. If the intangible asset can be rebuilt or replaced in a certain period of time, then the period of lost profit, which would be considered in valuing the intangible asset, is limited to the time to rebuild. The BEV represents the present value of the free cash flows available to the entitys debt and equity holders. The acquirer considers the margins for public companies engaged in the warranty fulfilment business as well as its own experience in arriving at a pre-tax profit margin equal to 5% of revenue. Typically, the initial step in measuring the fair value of assets acquired and liabilities assumed in a business combination is to perform a BEV analysis and related internal rate of return (IRR) analysis using market participant assumptions and the consideration transferred. These amounts are then probability weighted and discounted using an appropriate discount rate. The value of the business with all assets in place, The value of the business with all assets in place except the intangible asset, Difficulty of obtaining or creating the asset, Period of time required to obtain or create the asset, Relative importance of the asset to the business operations, Acquirer entity will not actively use the asset, but a market participant would (e.g., brands, licenses), Typically of greater value relative to other defensive assets, Common example: Industry leader acquires significant competitor and does not use target brand, Acquirer entity will not actively use the asset, nor would another market participant in the same industry (e.g., process technology, know-how), Typically smaller value relative to other assets not intended to be used, Common example: Manufacturing process technology or know-how that is generally common and relatively unvaried within the industry, but still withheld from the market to prevent new entrants into the market. The cash flows from the plant reflect only the economic benefits generated by the plant and its embedded license. WebOrder backlog Identified based on review of open purchase orders and / or in-progress projects as at the acquisition date and represents an intangible asset due to its contractual nature. Working capital is commonly defined as current assets less current liabilities. For example, the costs required to replace a customer relationship intangible asset will generally be less than the future value generated from those customer relationships. Nonetheless, reporting entities should assess the overall reasonableness of the discount rate assigned to each asset by reconciling the discount rates assigned to the individual assets, on a fair-value-weighted basis, to the WACC of the acquiree (or the IRR of the transaction if the PFI does not represent market participant assumptions). This should be tested both in the projection period and in the terminal year. Prior to the business combination, Company X was licensing the technology from Company B for a royalty of 5% of sales. Intangible assets that are used in procurement, the manufacturing process, or that are added to thevalue of the goods are considered a component of the fair value of the finished goods inventory. This method assumes that the NCI shareholder will participate equally with the controlling shareholder in the economic benefits of the post-combination entity which may not always be appropriate. To appropriately apply this method, it is critical to develop a hypothetical royalty rate that reflects comparable comprehensive rights of use for comparable intangible assets. The valuation model used to value the contingent consideration needs to capture the optionality in a contingent consideration arrangement and may therefore be complex. This results in the estimated fair value of the entitys BEV on a minority interest basis, because the pricing multiples were derived from minority interest prices. Company A is a manufacturer of computers and related products and provides a three-year limited warranty to its customers related to the performance of its products. Are you still working? Following are examples of two methods used to apply the market approach in performing a BEV analysis. If the acquirer does not legally add any credit enhancement to the debt or in some other way guarantee the debt, the fair value of the debt may not change. The concern with reliance on the value from the perspective of the asset holder is that assets and liabilities typically transact in different markets and therefore may have different values. Financial liabilities are typicallyinterest bearing and nonfinancial liabilities typically are not. When valuing intangible assets using the income approach (e.g.,Relief-from-royaltymethod ormulti-period excess earnings method) in instances where deferred revenues exist at the time of the business combination, adjustments may be required to the PFIto eliminate any revenues reflected in those projections that have already been received by the acquiree (because the cash collected by the acquiree includes the deferred revenue amount). An intangible asset or liability may be recognized for contract terms that are favorable or unfavorable compared to current market transactions or related to identifiable economic benefits for contract terms that are at market. For example, it would not be appropriate to assume normalized growth using the Forecast Year 3 net cash flow growth rate of 13.6%. An alternative to the CGM to calculate the terminal value is the market pricing multiple method (commonly referred to as an exit multiple). The steps involved in using MEEM to value an intangible asset are as follows: First, the valuator must review a cash flow forecast for the asset that has been developed by management. WebRecord project backlog of $93 million as of December 31, 2022, as compared to previously estimated backlog of approximately $87.0 million, a sequential increase of $26 million Completed acquisition of Houston, Texas based engineering firm, Dawson Van Orden, Inc. ("DVO") in October 2022 The multi-period excess earnings method (MEEM) is a valuation technique commonly used for measuring the fair value of intangible assets. This method is used less frequently, but is commonly used for measuring the fair value of remaining post-contract customer support for licensed software.